AUDIT & ASSURANCE

Delivering high-quality assurance services is at the heart of what we do.

We provide comprehensive audit & assurance services designed to deliver real value and underpin investor confidence. Leveraging our solutions-oriented approach, our commitment is to invest time in assessing our client’s business and finding practical solutions to assist them. We assist them to realise their organisational objectives, and methodology to facilitate senior personnel involvement at regular intervals throughout the process, thus ensuring value beyond the ambit of the audit report.

Audit & Assurance

The financial statement audit has never been more

important. In today's business environment there is more

scrutiny and skepticism of a company's financial

statements than ever before. Investors have lost faith

in corporate governance and reporting and they expect

greater reliability, more oversight and clear evidence

of internal controls. Meeting investor expectations

begins with the completeness and accuracy of information

contained in a company’s financial statements.

At Jayesh Sanghrajka & Co LLP., we have robust audit

tools, resources and procedures to provide the means for

our professionals to deliver high-quality audit

services. In delivering these services we adhere to the

auditing standards such as the Indian Standards on

Auditing and ethical guidelines and those issued by

Indian regulators and ICAI to maintain a level of

quality and trust of all stakeholders in the auditing

exercise.

For organisations that require an audit for statutory or

regulatory reasons associated with the filing of their

annual and periodic financial information, JSC can

provide high quality audit services.

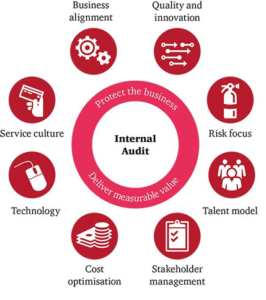

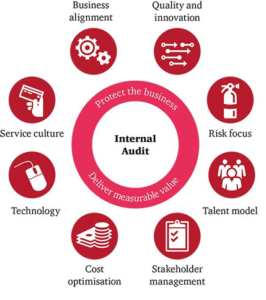

A strong, strategic Internal Audit framework integrates

compliance, controls and sophisticated risk management

with your mission, vision, and stakeholder expectations.

Keeping in mind the Risk Management framework, our

internal audits adopt ‘Risk Based Audit’ (RBA) approach

and other tools and techniques for accomplishing the

audit objectives. As such, it can help you shape a new

governance and risk paradigm - anticipating issues,

increasing your effectiveness, eliminating duplication

and identifying areas of potential performance

improvement.

Internal audit is also an effective means of

evaluating:

- Efficacy of operations

- Reliability of financial reporting

- Compliance with various regulations

- Safeguarding of assets and various matters concerning the interest of the company, employees, stakeholders and society in general

A Tax Audit involves an expression of the tax auditors’

opinion on the truth and correctness of certain factual

details, given by assessee to the Income Tax Authorities

to enable an assessment of tax.

Our endeavour is to mitigate the burden of tax and to

review that disallowances and deductions if any, under

the various provisions of Income Tax Act, 1961 are

properly and correctly calculated, so that the income

assessable can be computed correctly.

Tax Audit:

- Checking the correctness of the Claimable deductions as allowed in the Income Tax Act, 1961

- Effective reviews to see that the accounts are prepared in accordance with the tax efficient policies

- Checking the various tax compliance norms as set out by the Income Tax Act, 1961

- Certification of the books of account being in agreement with the Balance Sheet and Profit and Loss Account as per the requirements of the Income Tax Act, 1961.

- Issuing the Report of Tax Audit as required by the Income Tax Rules in the prescribed format.

Goods and Service Tax (GST) is structured for efficient

tax collection, reduction in corruption, easy

inter-state movement of goods and a lot more. Audit

under GST is the examination of records maintained by

a registered dealer. The aim is to verify the

correctness of information declared, taxes paid and to

assess the compliance with GST.

Every registered person having a turnover of more than

Rs. 2 Crores is liable for GST audit conducted by

Chartered Accountant or Cost Accountant. It involves

- Vouching and verification of invoices and supporting documents

- Reconciliation of income as per Profit/Loss account and income reflected in GST returns

- Filing annual return along with audit report.